Dear Readers,

Be Financially Literate And Apply Personal Tips To Achieve Financial Freedom With The Aid Of Using Calculator.me For Planning Purposes

I learn from mistakes when it comes to financial management. Why? As a young working adult, I neglected the importance of financial literacy and during those early years, I basically spent what I earn and enjoy life without considering the consequences in case of any emergency happen along the way.

I don't even have proper planning to own personal properties, but thankfully, my parents and seniors did enlighten me that change my way of spending and managing my available resources properly. It is true that "better late than never, but never late is better". So, it is crucial for us, especially young working adults to do the right thing from start.

Here are some of the personal tips that I start practicing to make sure that I achieve financial freedom in a shorter period of time.

Manage Daily Expenses With Cash Rather Than Credit Cards

Is credit cards the first item that you enroll when you finally have a stable and fix monthly income? It is so attractive to own one and you surely feel proud when you pay with credit cards, right?

To be honest, I am one of them and it can be really convenient when you have credit cards with you, even it is more attractive because some credit providers offer brilliant rewards when you spend using their credit facility.

But, here is the trap! You must always pay what you spend, not only the minimum payment to ensure a healthy spending habit, or else your overspending habit will bring you problems like you are still paying for those items you purchase now for many years in your bills.

Sound familiar, right? So, make it a habit to spend with cash or best with Debit Card which deducts the money from your saving account immediately at no charge. Be a wise spender too!

Start Emergency Funds

Saving what you have can be really difficult, because we tend to spend all that we have in our bank account. Hence, it required a lot of effort and discipline from us to make it a habit to start emergency funds.

The minimum rule of thumb when it comes to Emergency Fund saving is to have at least 6 months of resources from your current monthly spending and financial commitments. Of course, it will be great if you have more.

It was a brilliant decision when I pledge to make a compulsory deduction of 10% from my total salary to start up these emergency funds. Reaching 10 years of service this year, I am glad that this emergency fund has grown over the years and achieved the expectation.

Make It A Habit To Save With Money Box

Entering into the new year, I will start a new saving money box for me to save and make it a daily habit whenever I reach home to call it a day. This can be an interesting habit when you make it a routine, for example, every time you reach home, if you have RM 5, just put it into the money box.

Just imagine if you make this a habit every day for the whole year round, you will have an extra RM 1825 when you open the money box during the New Year. If not necessary to open, keep doing it and this can serve as a side emergency fund in case you need it urgently.

But remember, you need to be really disciplined when it comes to this as you can only use it when necessary, or else your year-long effort will be wasted.

Invest More Than Spending

|

| Invest Your Resources More Than Spending |

It is understandable the situation where we tend to spend whatever we earn to enjoy life, as a self-reward after the sweat and tears we shed daily for the earning. If this is you too, then you need to manage your funding wisely.

Yes, we can spend to reward ourselves as we work hard for it but just make sure that we invest to financially grow our resources more than our monthly spending. After all the savings for emergency funds, investment and commitment, the rest of the resources can be used upon your will.

Spend Wisely Based On Your Affordability

Now, this is the most important personal financial tip that I used as a benchmark whenever I want to make a financial decision. It is crucial when you want to decide to purchase items, by making sure that the items are a need, not a want and that you afford to own them without neglecting your financial burden.

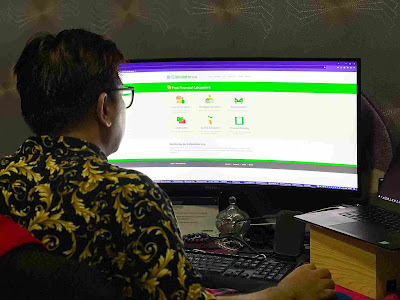

All thanks to this Calculator.me platform that I can easily use the calculator tools available on the web to perform the financial calculation. This involves Loan Amortization, Mortgage Calculators, Auto Calculators, Credit Cards, Saving Calculators and Financial Planning.

The best part is that I can use all the calculator tools for free to perform financial calculation accurately and this give me a better understanding of the spending or commitment before I make any decision.

Not only that, I found out that it is really simple to use and personally love the user-friendly interface with the minimum click required to achieve my goal of using the tool. If this is something that you need too, wait no more! Just kindly click the link below and start utilizing the tool.

Link:

|

| Calculator Used To Financially Calculate And Understand Your Spending |

|

| Credit Card Calculator Interface |

Hopefully these personal financial tips can help to improve our financial literacy knowledge and manage our resources wisely. If you have better tips that are worth to be added into these lists, feel free to drop your suggestion in the Comment below.

Enjoy reading, guys!.

Signing Off For Now And Take Care Till We e-Meet Again On My Next Post.

For Collaboration or Any Inquiries, Feel Free To Email Me At kitkatnelfei@gmail.com.

For Collaboration or Any Inquiries, Feel Free To Email Me At kitkatnelfei@gmail.com.

_11zon.jpg)

5 Comments

Thanks for sharing this informative article here, learnt so much the tips & gonna check out calculator me for more la. Cheers Siennylovesdrawing

ReplyDeletewow i never knew i needed a financial planner until i saw this. what an amazing way to help us spend smarter

ReplyDeleteWith current economic situation, having this to assist for saving would be very helpful.

ReplyDeletetips penyimpanan duit yang sangat bagus.. tq tau sharing suka baca

ReplyDeleteThese are good and practical tips for saving. We got to learn how to manage our personal finance

ReplyDelete